AutoZone: Beware of The Cannibal

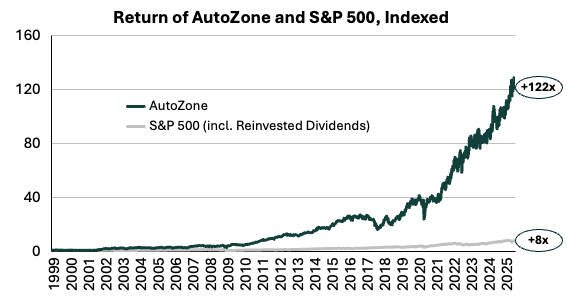

At first glance, selling auto parts might not seem like an exciting business; and in many ways, companies like AutoZone can be characterized as boring. Yet despite its mundane facade, AutoZone has been one of the most remarkable success stories in retail. Since its year-end results in 1998, its share price has increased from $30 to $3,683—a 122-fold increase, compounding at an annual rate of 20% and outperforming the S&P 500 by a wide margin.

AutoZone—originally named Auto Shack—was founded on July 4, 1979, in Forrest City, Arkansas, as a separate entity in the family-owned wholesale food distributor Malone & Hyde. AutoZone offers a wide selection of automotive aftermarket products to repair, maintain, or improve vehicles, serving both Do-It-Yourself customers and Do-It-For-Me professionals. It also provides additional services at no extra cost, such as diagnostic testing and access to specialized tools through its “Loan-A-Tool” program. These efforts aim to improve one of the most important factors in the industry: customer service.

Customer service has been in AutoZone’s DNA since its inception. It coined and trademarked the term “WITTDTJR” (What It Takes To Do The Job Right) and adopted a philosophy centered on delivering “WOW! Customer Service”. AutoZone has, in essence, created a culture where its employees, known as AutoZoners, are expected to consistently go above and beyond for customers.

And the results? Far from boring. Just four years after its founding, in 1983, AutoZone opened its 100th location. Today, it’s the largest retailer in the automotive aftermarket, operating 7,516 stores: 6,537 in the United States, 838 in Mexico, and 141 in Brazil. Despite its scale, and the presence of other nationwide competitors, the industry is fragmented, but consolidating, with smaller, independent repair shops holding a dominant position.

The automotive aftermarket is projected to grow at a mid-single-digit rate, driven by multiple trends. One of the most fundamental drivers of demand is total miles driven, as it affects the wear and tear of vehicles. With stable and low vehicle scrappage rates, the total number of vehicles on the road—known as the car park—is increasing, contributing to more miles driven and stronger future demand.

Another tailwind is the aging car park. The average vehicle age in the United States now exceeds 12 years, and since maintenance costs rise as vehicles get older, the automotive aftermarket directly benefits. AutoZone primarily services out-of-warranty vehicles, and with manufacturer warranties typically lasting around seven years, car purchases today can be translated into future demand. This lag effect improves the size estimate of the out-of-warranty car park, making the automotive aftermarket highly predictable.

During economic downturns, consumers tend to repair rather than purchase new vehicles. This drives demand for affordable repair solutions and aftermarket products, benefiting AutoZone as it appeals to cost-conscious customers, making the business more recession resistant.

What alternatives is there for transportation? Not many. One option is public transportation, but unlike many European and Asian cities, the United States lacks a well-developed transit infrastructure. While a few metropolitan cities offer viable options, most American cities are built around car dependency—making personal vehicles not just a preference, but a necessity.

The importance of private vehicles has a desirable result for the largest auto parts retailers like AutoZone: when vehicles need repairs, the immediate availability of auto parts often outweighs small price differences. With its vast store network and efficient distribution, AutoZone can monitor and replenish inventory levels—an advantage that smaller companies cannot match. With the car park consisting of hundreds of models across various categories like sedans, SUVs, and trucks, each often requiring specialized parts, AutoZone’s ability to source components quickly becomes a strong competitive advantage.

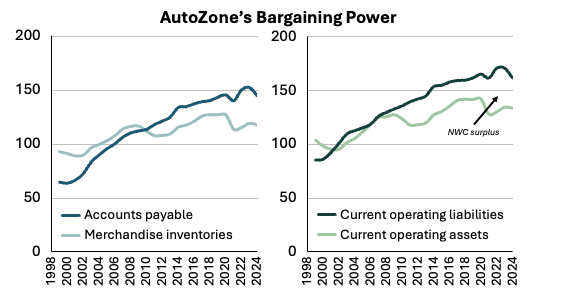

In the automotive aftermarket, size is king, not just improving distribution efficiency, but also enabling better supplier terms. These advantages are directly reflected into AutoZone’s financials. As the largest firm on the market, AutoZone has improved its accounts payable turnover—a key metric that measures how long it takes to pay suppliers—from 64 days in 1999 to 144 days in 2024. In contrast, its inventory turnover was 118 days in 2024, meaning AutoZone, on average, sells its products before paying for them, creating an attractive dynamic.

Inventory and accounts payable make up nearly all of AutoZone’s net working capital—the capital tied up in day-to-day operations. In fact, AutoZone has optimized its accounts payables to a point where its current operating liabilities now exceed its current operating assets. The result? AutoZone is provided short-term capital, totaling $1.5 billion in 2024, that it does not have an ownership claim over, but can deploy for value-creating investments, just like an insurance company uses its float.

In addition to improving capital efficiency, AutoZone’s bargaining power with suppliers enables it to reduce merchandise costs and manage operating expenses, which contributes to margin expansion. The largest auto parts companies have, furthermore, largely refrained from value-destructive tactics, such as price wars, and instead competed on quality of service and parts availability.

Over time, the effect of these has been translated into improved profitability, with the after-tax operating profit margin rising from 7% in 1998 to 16% in 2024.

Margin expansion and capital efficiency improvements have driven significant increases in return on invested capital—the yardstick for operational profitability and value creation. AutoZone’s return on invested capital has increased from 13% in 1999 to 45% in 2024, an impressive 32 percentage-point improvement. Essentially, each dollar invested in its operations returns 45 cents annually, after tax. Truly impressive.

AutoZone’s operations are not without risks. The most existential risk? Increased adoption of electric vehicles (EVs). EVs are more difficult to repair outside of dealerships and have fewer moving parts, reducing the demand for traditional auto parts. While EV adoption is accelerating, their share of the U.S. car park remains insignificant, currently estimated in the low single digits.

Several barriers limit EV adoption. One is inadequate charging infrastructure—the U.S. has fewer than 200,000 public charging stations, compared to 900,000 in Europe and 3.2 million in China. EVs have also become politically polarized in the U.S., which impacts government support in terms of subsidies and infrastructure investments.

As a result, while EVs eventually will affect the automotive aftermarket, the impact on AutoZone’s business is likely in the distant future. This limits the near term risk on AutoZone’s cash flows and, by extension, the present value of its shares.

Another risk is e-commerce. While platforms like Amazon have disrupted many retailers, the threat to the automotive aftermarket is limited. DIY customers often need help selecting and assembling parts; a service AutoZone provides. Additionally, the immediate in-store product availability is a major advantage, and thanks to AutoZone’s distribution, most parts can be sourced within the same day from nearby stores. Some items, like car batteries, cannot be shipped to private addresses, requiring an in-person visit to a brick-and-mortar retailer.

How about AutoZone’s management? They’ve proven themselves to be excellent stewards of shareholder capital. While cash flows have funded its store expansion, achieving impressive returns on capital, excess cash has been returned back to shareholders through share buybacks.

Charlie Munger, the former Vice Chairman of Berkshire Hathaway and Warren Buffett’s long-time partner, once remarked: “Pay close attention to the cannibals—the businesses that are eating themselves by buying back their stock.” One such cannibal is AutoZone. Since 1998, it has executed one of the world’s most aggressive share repurchase programs, reducing its outstanding share count by 89%. As a result, an investor’s ownership stake in AutoZone, without buying a single additional share, has increased ninefold over the period.

Buybacks can create value when shares are purchased below intrinsic value. AutoZone is often overlooked by investors due to its “boring” business model and absence of disruptive innovation. Instead, AutoZone has quietly compounded value for decades. This has contributed to AutoZone’s modest valuation, trading at a price-to-earnings multiple in the mid-teens for an extended period of time since 1998, indicating significant value creation from its share repurchase program.

AutoZone is a high-quality company, with a predictable and simple business model, and a proven management team with strong capital allocation skills. AutoZone currently trade at a forward free cash flow yield of 3.1%, based on consensus estimates.