Costco Wholesale: The Power of Scale Through Memberships

Walking into Costco would leave you with quite a unique shopping experience. Stacks of bulk products, limited decor, and huge stores—which, in fact, are warehouses—might give you the impression that you’ve walked into an industrial storage facility, instead of a traditional retailer. This is not by accident, however—it’s part of their formula, which have been perfected for decades.

Although Costco began its operations in 1983 in Seattle, Washington, it can trace its origins back to FEDCO—a membership department store founded by 800 U.S. Post Office employees in 1948 in Los Angeles, who wanted to combine their negotiating power by purchasing goods directly from vendors, and eliminate the mark-up of retailers. Costco has held true to this belief, but operates on a much larger scale: With operations primarily in the United States and Canada, and a presence in 14 countries through 896 membership warehouses, Costco provides significant value to its 137 million members.

Costco sells everything from groceries to appliances, jewelry, and more—primarily in bulk. Products are constantly rotated around in its warehouses, and new products are frequently introduced, creating a “treasure hunt” experience, which encourages members to explore the warehouse. This creates a sense of urgency and a desire to return, and it incentivizes members to strike on deals immediately. Costco also draws its members back into its warehouses with gas stations, pharmacies, tire installation, and its famous $1.50 hot dog and soda combo, which price has remained unchanged since the introduction in 1984. Additionally, Costco’s private label brand, Kirkland Signature, has become synonymous with high-quality products at low prices—and it’s an open secret that a lot of products are sourced from major brands.

For an annual fee of $65 or $130 for the Gold Star or Executive membership, respectively, Costco’s members gain access to its no-frills warehouses, where no stone is left unturned in the pursuit to find cost savings—the floors are of concrete to be more durable and easier to maintain, the ceilings have skylights to save on electricity, and the merchandise is stacked directly on the pallets, which they were delivered on, to save on labor costs. And the best part: All these costs savings are passed on directly to members through lower prices.

Costco limits its inventory to about 4,000 SKUs (different products)—a small fraction compared to competing retailers—allowing Costco to consolidate its purchases into larger volumes, improving its negotiating power, and further receive better prices from suppliers.

Costco’s business model is, thus, extremely simple: The huge number of members increase its negotiating power against suppliers, lowering its merchandise costs, which then are passed on to members through lower prices. The lower prices attract more members—and the cycle accelerates. In essence, Costco is an accumulation of the negotiating power of all its individual members—making scale its competitive advantage. While Walmart is its largest competitor, Costco is the largest retailer in the membership warehouse-segment, with Sam’s Club (owned by Walmart) and BJ’s Wholesale Club trailing behind.

Since members scan their membership cards at checkout, Costco gains a unique advantage into its member’s preferences, which assists in predicting which items to stock the shelves with. This increases the efficiency of their inventory, and is a contributor to their impressive inventory turnover levels, where all their inventory is turned over 14 times per year—or in less than once a month. On the supplier side, vendors are paid under 14 times per year—meaning that Costco, on average, pays for its inventories once these are sold on to its members. While companies usually have short-term capital tied up in inventory, receivables, etc., in the process to generate revenues, which inevitably turn into cash, the size of this working capital burden reflects the bargaining power companies have. Some rare companies, however, have a net working capital surplus, meaning capital is held at the company as a benefit, where it can earn a return—Costco is one of these rare companies, with its net working capital surplus comprising of almost 5% of revenues. Besides this, Costco is conservatively run, with a net cash position of about $3 billion.

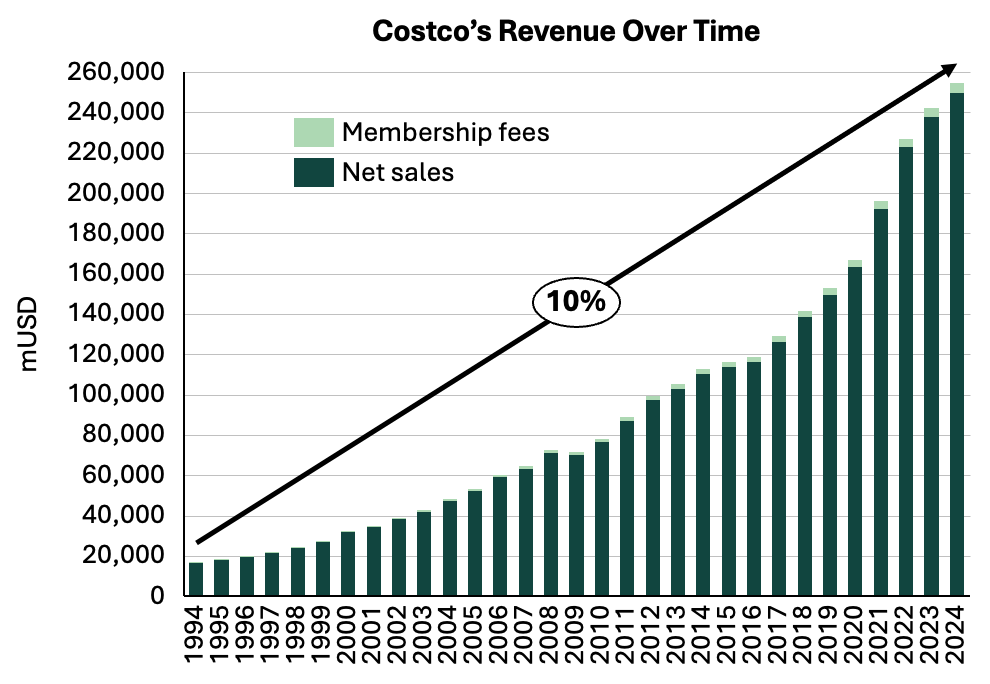

In the past 30 years, Costco has compounded its revenues with almost 10% per year—where about two-thirds have come from an increase in same-store sales. Since its founding, sales have decreased only once—in 2009, with a decline of 1.5%, compared to the 2008-level.

And what about margins? Costco has maintained extremely consistent margins over time, with gross margins of 12 to 13%—around half of Walmart’s. This is a result of Costco’s unconventional pricing strategy of having a lower mark-up on its merchandise. This level is, furthermore, ideal for breaking even with their merchandise sales—leaving the revenue from its membership fees comprise the bulk of its net profit. Costco’s business is, thus, akin to a subscription model, and with high customer loyalty, expressed as 90% membership renewal rates, Costco has a lot of recurring revenue.

Costco commitment to “Take Care of Our Employees” mirrors its dedication to its members. Its employees have better hourly salaries and benefits, compared to competing retailers, resulting in a high employee satisfaction—93% of U.S. and Canadian employees have been with Costco for over one year. The employee satisfaction, including the size of their bulk products, the strict control on entrances and exits, and their membership format, results in an industry-low level of shrinkage (inventory loss), where only .1% of sales value is lost, compared to the industry-level of about 1.5%. This makes a huge difference in Costco’s profitability, with its profit margin of almost 3%. Although the profit margin is razor-thin, Costco has a return on capital of almost 36%, driven by its high asset turnover.

Ron Vachris became the third CEO in Costco’s history at the start of 2024, after the previous CEO, Craig Jalinek, retired. Vachris started out as a forklift driver in 1984 in Price Club, which later merged with Costco. His long tenure at various positions reflects a strong cultural alignment with the company. Vachris also has a significant ownership of Costco shares, equal to about 38 times his annual base salary, further aligning him with shareholders.

Costco is, indeed, a high-quality business with a simple and predictable business model, a durable competitive advantage, and a shareholder-aligned management team. The quality is, however, reflected in its price—as it trades at a 1.6% free cash flow yield (based on 2024 results), or a forward yield of 1.8% (based on 2025 consensus estimates).

Great write-up