Novo Nordisk: A Century of Innovation in Metabolic Care

A little over a century ago, in 1921, Danish Nobel Prize laureate, August Krogh, on the urge of his wife, Marie—a doctor living with diabetes—travelled to Toronto, Canada. There, researchers had recently succeeded in manufacturing insulin, which is vital for treatment of diabetes. With permission to produce insulin for the Nordics, Marie convinced H.C. Hagedorn to join her husband and August Kongsted, her physician, in establishing Nordisk Insulinlaboratorium in 1923.

Two years later, in 1925, another company, Novo Terapeutisk Laboratorium was founded, sparking a rivalry between the two firms, lasting decades, and leading to innovations in the production of insulin. However, in 1989, the two competitors merged to form Novo Nordisk.

Today, more than a century after the visit to Toronto, Novo Nordisk has become the largest pure-play pharmaceutical company in metabolic care, specializing in the care of diabetes, obesity, and other chronic diseases—staying true to its purpose: [of] driving change to defeat serious chronic diseases.

Since the discovery of insulin, the demand for effective diabetes treatment has surged—fueled by significant changes to lifestyle and dietary habits. In fact, 1 in 10 adults, or over 500 million people, currently have type-2 diabetes—and this number is projected to increase to 800 million by 2045. Type-2 diabetes is linked to a series of health implications, such as lower life expectancy and cardiovascular disease, amplifying the need for effective treatment. With a market share of one third in diabetes care, and 43% in insulins, Novo Nordisk is the undisputed market leader.

Diabetes treatment has evolved dramatically—from early insulin injections derived from cattle and pigs, often causing allergic reactions and requiring multiple daily, self-dosed injections—Novo Nordisk currently has long-lasting, once-weekly insulin injections. However, the advancements in diabetes care are far from over. Novo Nordisk’s breakthrough development of semaglutide, marketed as Rybelsus and Ozempic in diabetes care, has revolutionized diabetes treatment. Semaglutide mimics the natural hormone GLP-1, and signals to the pancreas to release insulin. Additionally, semaglutide slows down digestion, leading to the feeling of being full for longer, and reduces appetite, lowering food intake—ultimately contributing to weight loss.

This breakthrough in diabetes care has synergies in another therapeutic area; obesity. Obesity, often misunderstood and stigmatized, affected more than 800 million adults in 2020 and this number is expected to surpass 1.2 billion by 2030. Besides the societal costs, obesity is associated with metabolic, cardiovascular and mechanical health complications—and life expectancy is substantially reduced.

Novo Nordisk has leveraged the innovations with semaglutide, initially developed for type-2 diabetes, to launch Wegovy, a weight-loss treatment that has demonstrated an average weight reduction of about 17%. Novo Nordisk currently has a GLP-1 market share of 65%, in both diabetes and obesity care, with Eli Lilly trailing behind.

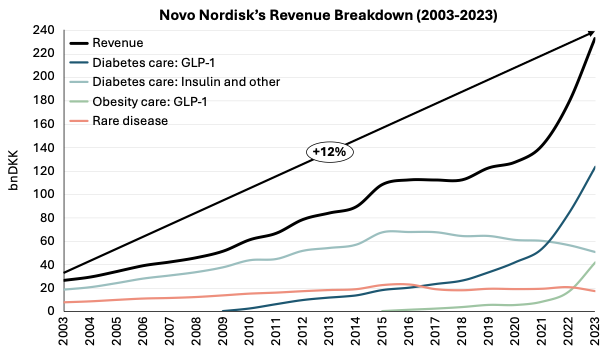

The company has achieved significant revenue growth over the past 20 years, compounding at an annual rate of almost 12%—accelerating to 22% in the past three years, driven exclusively by its GLP-1 product portfolio.

How about the rest of Novo Nordisk’s financials? Equally impressive. The company has a gross and operating margin of 85% and 44%, respectively. Combined with a high asset turnover, Novo Nordisk achieves a return on invested capital of nearly 90%—far surpassing its peers. Moreover, the company has no debt and a net working capital surplus to sales of 24%.

Novo Nordisk is expanding its product portfolio with innovative pipeline candidates. CagriSema—currently in Phase 3 trials—has demonstrated significant weight-loss benefits equal to 22.7%, and will benefit both the diabetes and obesity segments. Additionally, GLP-1, originally developed for diabetes and obesity care, is showing indications in the treatment of other chronic diseases, such as Alzheimer’s and Parkinson’s, further broadening Novo Nordisk’s therapeutic offerings—and delivering on its purpose to drive change to defeat serious chronic diseases.

So, what’s protecting Novo Nordisk against competition? Novo Nordisk holds a series of patents, protecting its active ingredients (for example, semaglutide) against biosimilars (similar versions of biologic drugs, such as insulin or semaglutide)—and for Novo Nordisk’s semaglutide products, Ozempic, Wegovy, and Rybelsus, patents extends until at least 2031. Novo Nordisk, furthermore, holds patents on its delivery systems, which enhances convenience for its patients. Also, continued investments in research and development will improve future treatments, extend patents, and limit the threat of competition.

The creation of a biosimilar is complex and costly—and although cheaper, compared to branded biologics, the cost difference is not substantial to warrant a huge loss of patients. This is due to physician and patient trust in the branded biologics, because of their familiarity with the brand and delivery system.

Additionally, Novo Nordisk draws benefits from its scale. With huge investments in research and development, and its century-long focus on protein and peptide engineering, Novo Nordisk has a deep expertise, which is difficult for newer competing companies to replicate. Novo Nordisk has, also, benefited from synergies with indications that overlap into other therapeutic areas—for example the discovery of the weight loss benefits of semaglutide, and possible benefits in other areas.

Ozempic and Wegovy have become brand names—and Novo Nordisk’s semaglutide drugs have received a cult following for their weight-loss benefits, spearheaded by celebrities and mentions in pop culture. With strong brand recognition, consumers trust and prefer Novo Nordisk’s products.

Lars Fruergaard Jørgensen is the CEO of Novo Nordisk, and joined the company in 1991—not long after the merger. Jørgensen has a significant ownership in Novo Nordisk stock, equal to about 17 times base salary, aligning him with shareholders. The Novo Nordisk Foundation, the largest charitable foundation in the world, controls 77% of the company’s voting rights, making Novo Nordisk able to focus on its long-term strategic vision, and shielding it from the pressures of short-term shareholders.

After more than a century since its founding, Novo Nordisk has achieved strong competitive advantages, and delivers highly-attractive products in growing, vast, and untreated markets. Novo Nordisk is currently trading at a forward free cash flow yield of 4.5%, based on 2025 consensus estimates.